Summary of Offering

No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this document. Any representation to the contrary is an offence. This Offering (as defined herein) may not be suitable for you and you should only invest in it if you are willing to risk the loss of your entire investment. In making this investment decision, you should seek the advice of a registered dealer.

These securities have not been registered under the United States Securities Act of 1933, as amended (the “ U.S. Securities Act”), or any of the securities laws of any state of the United States, and may not be offered or sold within the United States or for the account or benefit of U.S. persons or persons in the United States except pursuant to an exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This offering document does not constitute an offer to sell, or the solicitation of an offer to buy, any of these securities within the United States or to, or for the account or benefit of, U.S. persons or persons in the United States. “United States” and “U.S. person” have the meanings ascribed to them in Regulation S under the U.S. Securities Act.

Offering Document under the Listed Issuer Financing Exemption June 15, 2023

What are we offering?

Coho, is conducting a listed issuer financing under section 5A.2 of National Instrument 45-106 Prospectus Exemptions (“NI 45-106”). In connection with this Offering, the Company represents the following is true:

• The Company has active operations and its principal asset is not cash, cash equivalents or its exchange listing.

• The Company has filed all periodic and timely disclosure documents that it is required to have filed.

• The total dollar amount of this Offering, in combination with the dollar amount of all other offerings made under the listed issuer financing exemption in the 12 months immediately before the date of this offering document, will not exceed $5,000,000.

• The Company will not close this Offering unless the Company reasonably believes it has raised sufficient funds to meet its business objectives and liquidity requirements for a period of 12 months following the distribution.

• The Company will not allocate the available funds from this Offering to an acquisition that is a significant acquisition or restructuring transaction under securities law or to any other transaction for which the Company seeks security holder approval.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the Company, certain statements in this offering document may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to the Company’s future outlook and anticipated events or results and, in some cases, can be identified by terminology such as “may”, “will”, “could”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “projects”, “predict”, “potential”, “targeted”, “possible”, “continue” or other similar expressions concerning matters that are not historical facts. In particular, this offering document contains forward-looking statements pertaining to the following:

• the use of the available funds following completion of the Offering and the Concurrent Offering (as defined herein);

• the ability of the Company to secure debt financing for the Acquisition;

• the ability of the Company to refinance current liabilities in the future in order to improve its working capital position;

• the expected Closing Date; and

• the principal business carried on and intended to be carried on by the Company.

Forward-looking information contained in this offering document is based on assumptions about future events, including economic conditions and proposed courses of action, based on management’s assessment of the relevant information currently available, and on other material factors, including but not limited to those relating to:

• the availability and final receipt of required approvals, licenses and permits;

• sufficient working capital to develop and operate any future locations;

• access to additional capital, including equity and debt, and associated costs of funds;

• access to adequate services and supplies;

• foreign currency exchange rates;

• interest rates;

• the satisfaction of certain conditions in connection with the Acquisition (as defined herein);

• the closing of a debt financing transaction with BMO;

• availability of a qualified work force; and

• the effects of COVID-19 on the global economy and the ability of the Company to secure adequate staff and equipment for the operations of the Company as well as a safe environment that follows recommended COVID-19 safety protocols.

While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation known and unknown risks, uncertainties and other factors as disclosed under the heading “Risks and Uncertainties” and “Risk Factors” in the Company’s disclosure documents filed from time to time with the securities regulators in certain provinces of Canada. In addition, a number of other factors could cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information, and there is no assurance that the actual results, performance or achievements of the Company will be consistent with them.

To the extent any forward-looking statement in this offering document constitutes “future-oriented financial information” or “financial outlooks” within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the anticipated market penetration and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information and financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to the risks set out herein. The Company’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, the Company’s revenue and expenses. The Company’s financial projections were not prepared with a view toward compliance with published guidelines of International Financial Reporting Standards and have not been examined, reviewed or compiled by the Company’s accountants or auditors. The Company’s financial projections represent management’s estimates as of the dates indicated thereon.

Readers are cautioned that any such forward-looking information should not be used for purposes other than for which it is disclosed. Such forward-looking statements and information are made or given as at the date given and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required under applicable securities law. Readers are cautioned not to place undue reliance on forward-looking statements or forward-looking information.

SUMMARY DESCRIPTION OF BUSINESS

What is our business?

Coho is a growth stage, community-driven, commercial real estate and food technology company that provides private and shared kitchen and production space to food companies from start-ups to restaurant groups seeking turnkey solutions and business services.

Purebread. Bakery Inc. (“Purebread”) is one of Canada's fastest growing and most respected independent bakery and cafe businesses, with 7 retail locations, and one central production facility, all in Western Canada.

Recent developments

The following is a brief summary of key recent developments involving or affecting the Company, including:

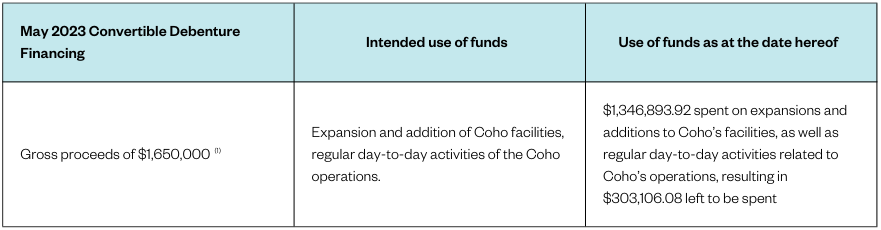

• On May 9, 2023, the Company announced convertible debenture financing of $1,650,000;

• On May 24, 2023, the Company announced the opening of its 8th and 9th locations, as well as the closing of the previously announced convertible debenture financing;

• On May 29, 2023, the Company announced that it had entered into a purchase agreement to acquire all (100%) of

the issued and outstanding securities of Purebread (the “Acquisition”); and

• On June 14, 2023, Purebread opened a new location at the Vancouver International Airport.

Material facts

There are no material facts about the securities being distributed that have not been disclosed in this offering document or in any other document filed by the Company in the 12 months preceding the date of this offering document.

What are the business objectives that we expect to accomplish using the available funds?

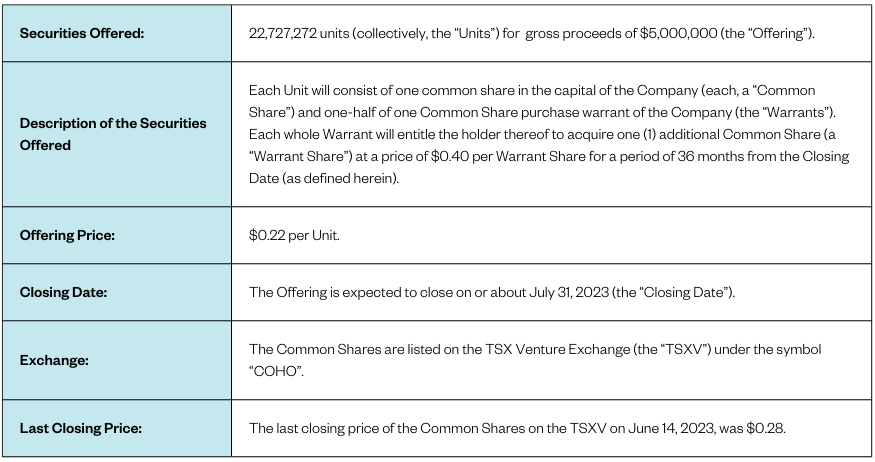

The Company intends to issue 22,727,272 Units for gross proceeds of $5,000,000 pursuant to the listed issuer financing exemption under part 5A.2 of NI 45-106. Concurrently, the Company also intends to complete a brokered private placement of 4,545,455 Units for gross proceeds of up to $1,000,000 pursuant to other prospectus exemptions under NI 45-106 (the “Concurrent Offering”).

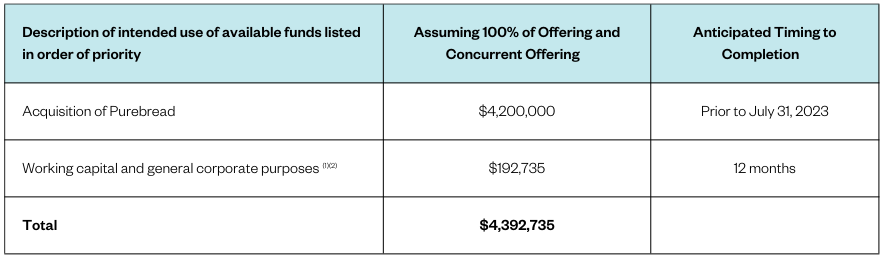

After completion of the Offering and the Concurrent Offering, the Company intends to use approximately $4,200,000 of the available funds to complete the Acquisition. The closing of the Company’s Acquisition is also contingent on the Company closing a concurrent debt financing with BMO, as well as the satisfaction of certain conditions set out in the Purchase Agreement (as herein defined) executed in connection with the Acquisition.

After completion the Offering and the Concurrent Offering, the Company also intends to use approximately $192,735 of the available funds for working capital and general corporate purposes over a period of 12 months following closing of the Offering and the Concurrent Offering.

USE OF AVAILABLE FUNDS

What will our available funds be upon the closing of the Offering and the Concurrent Offering?

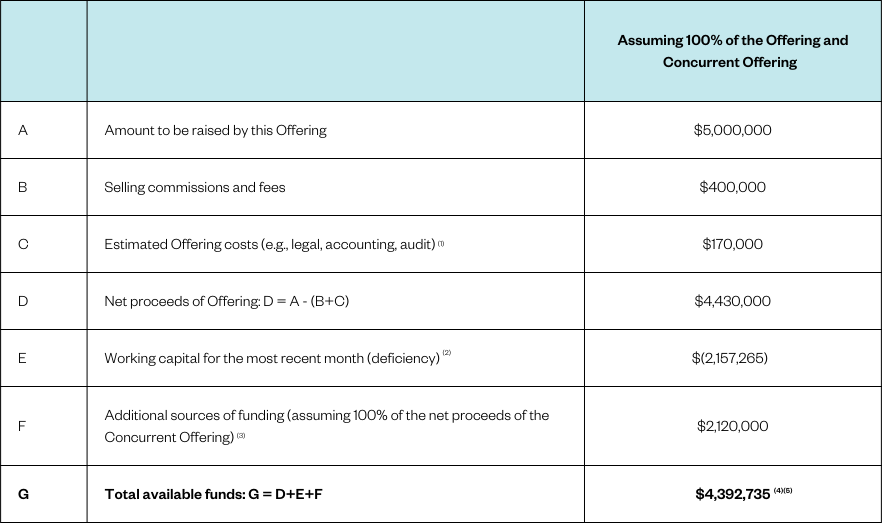

The expected total available funds to the Company following completion of the Offering and the Concurrent Offering is estimated to be approximately $4,392,735.

Notes:

(1) Comprised of the cash portion of the Lead Agent’s corporate finance fee ($50,000) and the Lead Agent’s estimated legal fees ($60,000).

(2) Estimated and unaudited working capital is provided as at May 31, 2023. The decline in working capital since the Company’s most recent audited financial statements (for the year ended March 31, 2022) is primarily due to loans from the Company’s private lenders that are currently classified as current, but were previously classified as non-current in the most recently audited financial statements. As at December 31, 2022, the date of the Company’s most recent interim financial statements prior to the date hereof, approximately $1.65 million of these loans were classified as current, contributing to approximately 50% of the working capital deficiency. Management fully expects to extend the maturity dates of the current loans with the private lenders. In addition, on May 9, 2023, the Company announced a convertible debenture financing of $1.65 million that subsequently closed on May 24, 2023 (the “Convertible Debenture Financing”). The Convertible Debenture Financing further improves the Company’s working capital since the most recently audited financial statements.

(3) Includes net proceeds from the Concurrent Offering and external debt financing.

(4) Net proceeds from the Offering and the Concurrent Offering assume a cash fee of 8% payable to the Agents in connection therewith.

(5) The cash fee payable to the Agents shall be reduced to 3% for certain president’s list investors under the Offering and the Concurrent Offering (the “President’s List”). Figures provided above assume no subscribers will appear on the President’s List, which would reduce the fees payable by the Company to the Agents.

How will we use the available funds?

Note:

(1) Working capital and general corporate purposes is expected to include salaries, professional fees and general and administration expenditures.

(2) On May 29, 2023, the Company announced that it had entered into a purchase agreement to acquire all (100%) of the issued and outstanding securities of Purebread. Given the immediate positive impact on the Company’s revenue and net income due to Purebread’s existing profitable operations, in addition to Purebread’s latest location opening on June 14, 2023 at the Vancouver International Airport, management firmly believes that the Company’s working capital needs will be well-funded and maintained by the combined operations of the Company and Purebread over the next 12 months. As a result, the amount allocated for working capital and general corporate purposes as part of this Offering is sufficient.

On May 29, 2023, Coho announced that it had entered into a share purchase agreement dated May 28, 2023 among Twin Lakes Investments Inc., Paula Lamming, Mark Lamming, Jack Lamming (collectively, the “Vendors”), Purebread, and Coho Acquisition Corp. in connection with the Acquisition (the “Purchase Agreement”).

Under the Purchase Agreement, Coho Acquisition Corp., Coho’s wholly owned subsidiary, will acquire all of the issued

and outstanding securities of Purebread from the Vendors. The Purchase Agreement provides for cash consideration of $10 million (subject to customary adjustments, the “Cash Purchase Price”) and the issuance of one million Common Shares (collectively, the “Purchase Price”). The Cash Purchase Price will be paid to each of the vendors based on their pro-rata ownership of Purebread. Purebread and the Vendors are arm’s length parties to Coho.

Purebread is one of Canada's fastest growing and most respected independent bakery and cafe businesses. Purebread’s existing team currently operates six locations and will work with Coho following the closing of the Acquisition. Following the closing of the Acquisition, it is expected that Purebread’s existing team will continue to operate the brand under its current name, with plans to expand operations nationally. Purebread’s unaudited financial statements indicate that it is currently generating annual revenue of over $10 million, with a strong profit margin and clear path to scale.

In order to complete the Acquisition, Coho Acquisition Corp. has entered into a letter of agreement with the Bank of Montreal (“BMO” or the “Lender”), setting out the terms under which BMO will provide up to $5.9 million in senior secured credit facilities (the “Facilities”). The Facilities will consist of a $5.5 million non-revolving term facility (the “Term Facility”), a $300,000 revolving facility (the “Revolving Facility”), and a $100,000 corporate credit card facility. The Term Facility and Revolving Facility are intended to be used to finance a portion of the Cash Purchase Price and for general corporate purposes. The Term Facility and Revolving Facility will bear interest at a rate not to exceed prime plus 125 basis points. The Term Facility will amortize monthly beginning the first full quarter following closing of the Acquisition, with repayments of the Term Facility made over an 84 month period. The Revolving Facility is repayable on demand. Interest on the Facilities will be payable monthly in arrears. Upon closing the Acquisition, it is expected that the Facilities will be secured by a first ranking security interest over all present and after-acquired personal property of Coho Acquisition Corp., which entity will hold all of the issued and outstanding shares of Purebread at the time the Acquisition closes.

The closing of the Facilities is expected to occur contemporaneously with or prior to the Acquisition, and will be subject to customary closing conditions including, but not limited to, the receipt of certain third party consents and the approval of the TSXV.

The above noted allocation of capital and anticipated timing represents the Company’s current intentions with respect to its use of proceeds based on the current knowledge, planning, and expectations of management of the Company, which could change in the future as its plans and business conditions evolve. Although the Company intends to spend the proceeds from the Offering and the Concurrent Offering as set forth above, there may be circumstances where, for sound business reasons, a reallocation of funds may be deemed prudent or necessary and may vary materially from that set forth above, as the amounts actually allocated and spent will depend on a number of factors, including the Company’s ability to execute on its business plan. See the “Cautionary Statement Regarding Forward-Looking Information” section above.

The most recent audited annual financial statements and interim financial report of the Company included a going concern note. The Company is a growth stage company and the Company has not yet generated positive cash flows from its operating activities, which may cast doubt on the Company’s ability to continue as a going concern. The Offering and the Concurrent Offering are intended to facilitate the Acquisition. While Coho’s management believes that the Offering, Concurrent Offering, and Acquisition are in the best interests of the Company, these transactions are not expected to affect the decision to include a going concern note in the next annual financial statements of the Company.

How have we used the other funds we have raised in the past 12 months?

Note:

(1) As a non-brokered financing, no finder’s fees or commissions were payable by Coho in connection with this transaction.

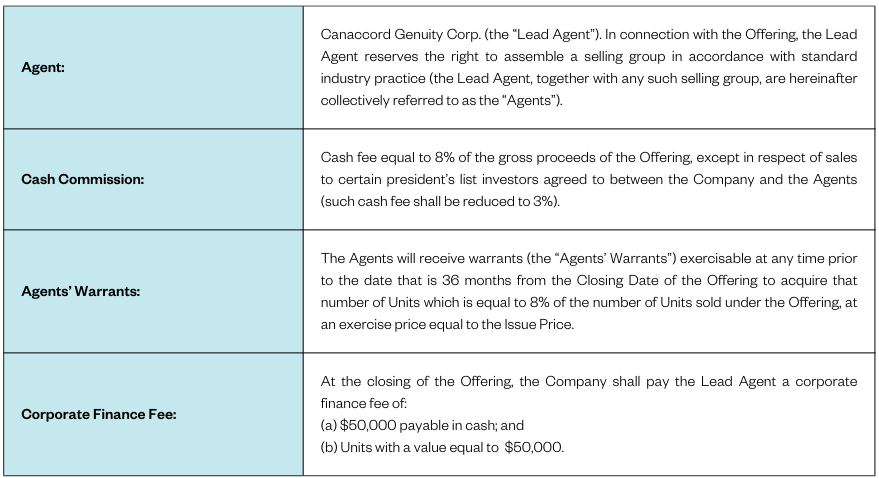

FEES AND COMMISSIONS

Who are the dealers or finders that we have engaged in connection with this Offering, if any, and what are their fees?

Does the Lead Agent have a conflict of interest?

To the knowledge of the Company, it is not a “related issuer” or “connected issuer” of or to Canaccord Genuity Corp., as

such terms are defined in National Instrument 33-105 Underwriting Conflicts.

PURCHASERS’ RIGHTS

Rights of Action in the Event of a Misrepresentation

If there is a misrepresentation in this offering document, you have a right

(a) to rescind your purchase of these securities with the Company, or

(b) to damages against the Company and may, in certain jurisdictions, have a statutory right to damages from other persons.

These rights are available to you whether or not you relied on the misrepresentation. However, there are variouscircumstances that limit your rights. In particular, your rights might be limited if you knew of the misrepresentation when you purchased the securities.

If you intend to rely on the rights described in paragraph (a) or (b) above, you must do so within strict time limitations.

You should refer to any applicable provisions of the securities legislation of your province or territory for the particulars of these rights or consult with a legal adviser.

ADDITIONAL INFORMATION

Where can you find more information about us?

Security holders can access the Company’s continuous disclosure filings on SEDAR at www.sedar.com under the Company’s profile.

For further information regarding the Company, visit our website at: https://www.cohocommissary.com/.

Investors should read this offering document and consult their own professional advisors to assess the income tax, legal, risk factors and other aspects of their investment of Units.

CERTIFICATE OF THE COMPANY

This offering document, together with any document filed under Canadian securities legislation on or after June 15, 2022, contains disclosure of all material facts about the securities being distributed and does not contain a misrepresentation.

June 15, 2023

“Andrew Barnes” “Michael Yam”

Andrew Barnes Michael Yam

Chief Executive Officer & Director. Chief Financial Officer